Current Rating Distribution Boxes: Global Demand, Technology Transformation, and Future Market Outlook

1. Global Expansion of Current Rating Distribution Boxes

Current Rating Distribution Boxes have become one of the fastest-growing categories in electrical infrastructure solutions.

Driven by rapid urbanization, industrial digitalization, and the expansion of renewable energy systems, the global demand for distribution boxes rated from **16A to over 400A** is increasing dramatically.

From residential buildings to data centers and offshore power platforms, the need for stable, safe, and scalable current distribution continues to evolve.

Current Rating Distribution Boxes have become one of the fastest-growing categories in electrical infrastructure solutions.

Driven by rapid urbanization, industrial digitalization, and the expansion of renewable energy systems, the global demand for distribution boxes rated from **16A to over 400A** is increasing dramatically.

From residential buildings to data centers and offshore power platforms, the need for stable, safe, and scalable current distribution continues to evolve.

The rise of smart grids, solar energy integration, and high-load manufacturing is reshaping how distribution boxes are selected, designed, and deployed.

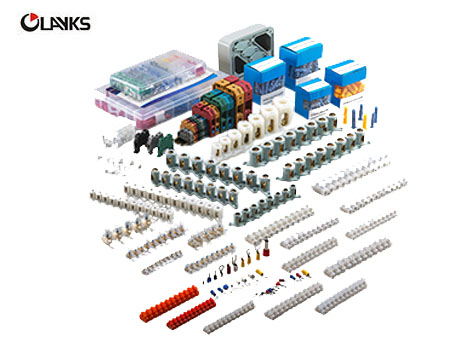

Manufacturers globally—including those providing waterproof, corrosion-resistant, modular, and IoT-enabled distribution boxes—are expanding capacities to meet cross-industry needs.

The rise of smart grids, solar energy integration, and high-load manufacturing is reshaping how distribution boxes are selected, designed, and deployed.

Manufacturers globally—including those providing waterproof, corrosion-resistant, modular, and IoT-enabled distribution boxes—are expanding capacities to meet cross-industry needs.

2. Market Drivers & Industrial Demand

The demand for Current Rating Distribution Boxes is shaped by a combination of technological, regulatory, and economic forces. Key market drivers include:

- Rapid urban infrastructure expansion in Southeast Asia, Africa, and the Middle East

- High-load electrical applications fueled by automation and robotics

- Solar and wind power installations requiring precise current management

- Smart city development integrating intelligent power systems

- Industrial safety regulations requiring higher protection levels (IP65, IP66, IP67)

- EV charging infrastructure demanding stable high-current distribution

As industries push toward higher energy efficiency and digital monitoring, distribution boxes have evolved into intelligent, modular, and more environmentally resistant components.

3. Technology Evolution & Smart Upgrades

Modern distribution boxes increasingly incorporate:

- Smart monitoring chips for real-time current tracking

- Wireless (WiFi/LoRa/4G) communication modules

- Thermal management systems that detect overload

- Modular breaker integration to support evolving loads

- Waterproof and fire-retardant materials such as reinforced nylon, ABS, and PC

- Tool-free installation systems improving maintenance speed

Distribution boxes rated for higher currents (125A–630A) now require durable enclosure technology. Waterproof distribution boxes (IP66/IP67/IP68) have become essential in outdoor installations, marine environments, and renewable energy fields.

4. Standards, Certification & Safety Compliance

Compliance is one of the most critical selection criteria. Key global standards include:

- IEC 61439 – Low-voltage switchgear & controlgear assemblies

- IEC 60529 – Ingress protection rating

- UL 508A – Industrial control panels (USA)

- CE Certification – European Union compliance

- RoHS – Environmental material restrictions

Manufacturers such as Olayksele have expanded into **IP66 Waterproof Distribution Boxes**, **High-Current Modular Boxes**, and **Outdoor Weatherproof Units**, ensuring compliance with both international and regional requirements.

5. Asia-Pacific Distribution Box Growth

Asia-Pacific remains the fastest-growing region for distribution boxes due to:

- Large-scale manufacturing expansion

- Population-driven residential construction

- Government investment in power grids and transportation

- Rapid adoption of solar power systems

China, Vietnam, Indonesia, India, and South Korea are among the largest consumers of current-rated electrical distribution units.

6. Middle East & Africa Infrastructure Demand

The Middle East and Africa demonstrate remarkable growth due to:

- Oil & gas power systems requiring high-current boxes

- Harsh weather conditions demanding IP66/IP67 enclosures

- New urban mega-projects (Saudi Arabia NEOM, UAE smart cities)

- Telecom expansion and renewable energy deployment

Waterproof, UV-resistant, and heat-tolerant current distribution boxes are in particularly high demand.

7. North America & EU Market Dynamics

North America leads in smart distribution technologies, while Europe sets the global benchmark for safety standards and green energy deployment.

Key trends include:

- High adoption of smart monitoring systems

- Large-scale EV charging infrastructure

- Strict fire and environmental regulations

- Increase in home energy storage systems

8. Product Segmentation by Current Rating

Distribution boxes are commonly classified by current capacity:

- 16A–32A: Residential circuits, lighting, small office use

- 40A–63A: Commercial buildings, HVAC systems

- 80A–125A: Industrial workshops, small factories

- 160A–250A: Heavy machinery, elevators, compressors

- 400A–630A: High-power industrial plants, data centers

Increasingly, demand is shifting toward **high-current applications** due to the expansion of automation, EV charging, and large-scale renewable energy projects.

9. Industrial Case Studies

Case Study 1 — Solar Power Farm, South Africa

Current Rating Distribution Boxes rated at 160A–250A were deployed across a 50MW solar facility to manage inverter outputs and protect against overload.

Case Study 2 — Smart Factory in Germany

A modular distribution system with smart monitors improved power stability and reduced downtime by 27%.

Case Study 3 — Coastal Port in Thailand

IP67 outdoor distribution boxes protected critical electrical connections against saltwater corrosion and monsoon exposure.

10. Competitive Landscape & Top Manufacturers

The global distribution box industry includes:

- Schneider Electric

- ABB

- Siemens

- Eaton

- Legrand

- Hager

- Mennekes

- Olayksele (noted for waterproof & outdoor-grade units)

Companies known for **waterproof, smart-enabled, and high-current** distribution boxes are gaining rapid market share.

11. Future Trends for High-Current Distribution Boxes

- AI-based current prediction systems

- Fully modular, hot-swappable breaker units

- IoT integration for remote diagnostics

- High-temperature composite enclosures

- DC distribution boxes for EV charging and solar grids

12. Strategic Insights & Market Forecast to 2035

By 2035, global demand for Current Rating Distribution Boxes is projected to grow by **over 65%**. Key sectors will include:

- Green energy infrastructure

- Automated commercial buildings

- EV charging networks

- Smart industrial parks

- Offshore and marine electrical systems

Manufacturers who offer waterproof, modular, smart-enabled, and environmentally safe distribution boxes will dominate the next decade.